Written by Eduard Elias

The opportunity of impact transparency

Long-accepted ideas regarding corporate growth and economic development are being threatened by known and unknown risks in our natural and economic environment. Aside from the COVID-19 crisis, the ongoing trends of nationalism-related trade wars, aging populations, wealth disparities, and global warming, are making this new decade, the Twenty-Twenties, a very challenging decade. As uncomfortable as this may sound, the next ten years may also be a time of opportunity to rethink traditional economic values of ever-continued growth and a narrow focus on a monetary shareholders’ value.

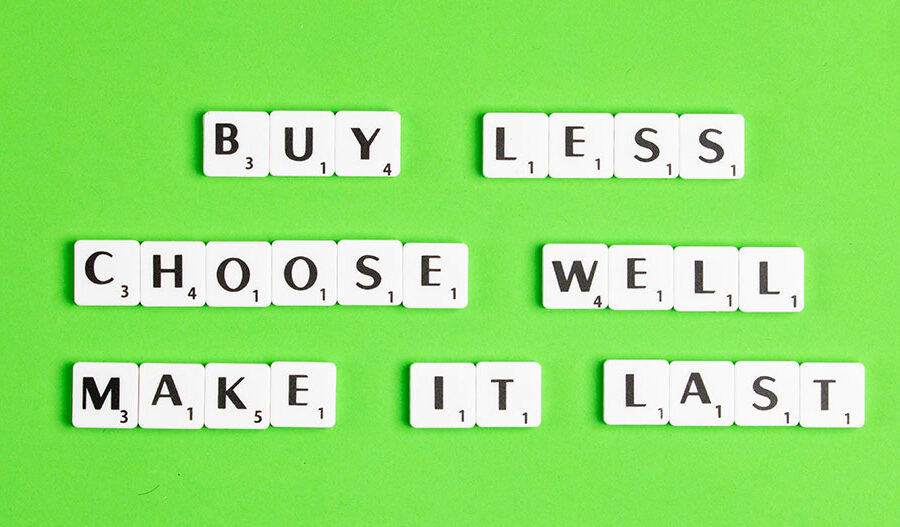

In rethinking corporate strategies, the focus should shift from growth to resilience, and from shareholders to stakeholders. These stakeholders will encompass customers, employees, society, our natural environment and, of course, shareholders. A focus on keeping customers happy, keeping employees engaged and creative, adding value to society and making processes sustainable should be the norm when rethinking corporate strategies. Basically, taking a holistic view on the impacts and changes caused by a company. This impact can be positive or negative, intended, or unintended.

By focusing on overall impacts, instead solely on growth, one can create Smart Growth. Smart Growth is a form of growth, which not just involves generating monetary gain for shareholders, but also creates a positive value for all stakeholders, such as staff, local communities, society, and our environment. Smart Growth requires as much focus on growing the impact of a company as its financial progress.

Issues such as carbon footprint, labour policies, community engagement and investment, are becoming more important for institutional investors, especially for pension funds and endowments. “More than US$30 trillion are currently flowing in impact investments, equivalent to more than a third of the world’s professionally-managed assets. They are already doing their best to integrate climate change, employee diversity and customer health into their investment decisions” according to Ronald Cohen and George Serafeim in Harvard Business Review (HBR).[i]

As investors increasingly look for companies with clear Environmental Social Governance (ESG) goals and constructive impacts, Smart Growth tactics have a clear, positive value impact for shareholders. Research by George Serafeim at Harvard Business School shows that a ESG focus can help reduce cost of capital while also improving a company’s valuation. He states “as more investors look to put money into companies with stronger ESG performance, larger pools of capital will be available to those companies. Positive action and transparency on ESG matters can help companies protect (or raise) their valuations”.[ii]

That said, corporate ESG policies should not be seen as ‘tick box’ exercises. Companies must move beyond window dressing and make ESG measures an integral part of their competitive strategy. The real challenge here is also the biggest opportunity – a chance to make a genuine business impact while demonstrating business impact transparency.

A very interesting initiative is the Impact-Weighted Accounts Initiative (IWAI) at Harvard Business School, which last July published the cost of the environmental impact of 1,800 companies and next year will publish, as well, the cost of product and employment, providing a complete picture of a company’s true impact. A similar initiative is the Impact Institute, in Amsterdam, which assists companies on reporting impacts in an Integrated Profit & Loss account (IP&L). This IP&L provides an impact measurement and reporting tool that solves some key problems of impact reporting, as it calculates all impacts back to a monetary value, producing a true price that more accurately reflects the business’s total impact footprint.

Impact transparency will have far-reaching consequences, as investors begin to price the environmental and social impacts of companies into their investment analysis. It is my belief that a trend towards Smart Growth will be driven by encouraging greater transparency of the way companies account for their benefits, costs and impacts on society and the wider environment.

Smart Growth will make companies become more relevant to society and therefore more resilient. It will also create long-term shareholder value as climate action, sustainability and impact on society increasingly redefine how we measure business success.

[i] How to Measure a Company’s Real Impact, by Ronald Cohen and George Serafeim, Harvard Business Review website, 03 September 2020

[ii] Social-Impact Effort That Create Real Value, by George Serafeim, Harvard Business Review, September-October edition

About the Author:

Eduard Elias, founder of Cycas Capital, has over 25 years’ international experience in debt finance and financial structuring.